- Home

- »

- Chartered Accountancy (CA)

CA - Offline & Online Classes

CA - Video Classes

Get 30% OFF on Admission Fees

2025 Ultimate CA Course: Empower Your Accounting Career!

Welcome to the page that will change your accounting career forever! In the fast-paced world of finance, staying ahead is essential. Discover the “2025 Ultimate CA Course: Empower Your Accounting Career!”

Whether you’re a student or an experienced professional, this comprehensive guide offered by Stride Edutech will reveal new opportunities and transform your accounting prowess.

Let’s embark on a journey that will shape your future and propel you towards success.

What is a Chartered Accountant (CA) Course?

The Institute of Chartered Accountants of India (ICAI) offers the Chartered Accountant (CA) course as a professional credential. It is a thorough programme that gives students information, abilities, and expertise in various accounting, financial, tax, auditing, and business advisory services areas.

The CA course is designed to develop professionals who excel in financial management, corporate accounting, strategic planning, and compliance.

It involves multiple examinations, practical training, and professional development to ensure that individuals attain high competence and ethical standards to become successful Chartered Accountants.

How many Levels are there in a Chartered Accountancy (CA) Course, and what is the eligibility for each level?

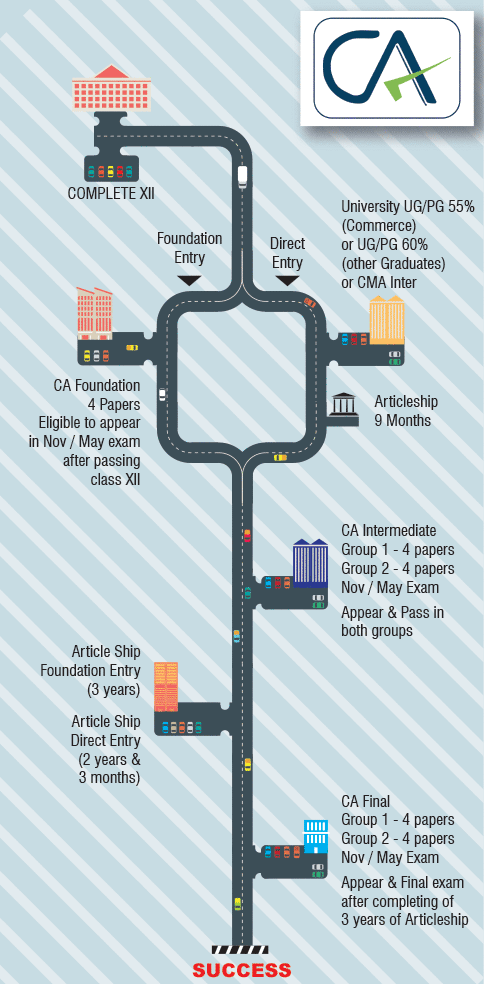

The Chartered Accountancy (CA) course has three levels: Foundation, Intermediate, and Final.

Foundation Level

The CA Foundation Examination is a preliminary examination that tests the candidate’s basic accounting, finance, and economics knowledge.

Eligibility for Foundation Level

Educational Qualification: This is an entry to the CA Course for the candidates who have appeared for class XII examinations.

Under this route, a Class X passed student may register himself with the Board of Studies (BoS) of the Institute for the Foundation Course.

Intermediate Level

The CA Intermediate Examination is a more comprehensive examination that tests the candidate’s accounting, auditing, taxation, and law knowledge.

Eligibility for Intermediate Level

- After qualifying Foundation Course, or

- Through Direct Entry,

The ICAI allows the following candidates to enter directly to its Intermediate Course:

a. Commerce Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/ Post-Graduates (with minimum 60% marks) and

b. Intermediate level passed candidates of The Institute of Company Secretaries of India and The Institute of Cost Accountants of India.

Final Level

The CA Final Examination is the most challenging in the CA course and tests the candidate’s mastery of all aspects of accounting and finance.

For more information on the eligibility requirements, registration process, examination dates, and other requirements, please visit the official website: https://www.icai.org/

What is the pass percentage for Chartered Accountancy (CA) Course?

The pass percentages for the Chartered Accountancy (CA) exams in India have typically been as follows:

- Foundation Course: The pass percentage for the Foundation course has ranged from 20% to 30% in recent years.

- Intermediate Course: The Intermediate course’s pass percentage is usually higher than the Foundation level. It has varied between 15% to 30% for different attempts.

- Final Course: The final course’s pass percentage is generally lower than the Intermediate level. It has ranged from 10% to 20% in recent years.

Note: These figures are not official and are meant to give you a rough idea of the pass percentage trends.

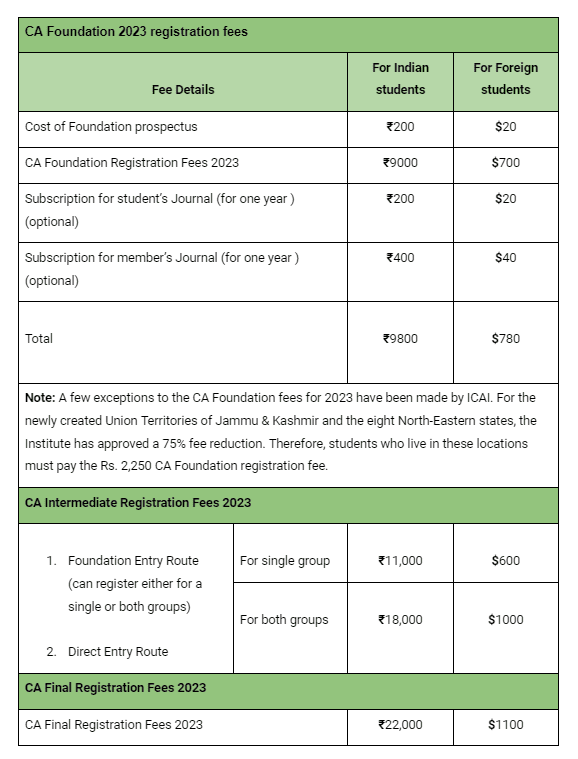

What are the Registration Fees for Chartered Accountancy (CA) Course in 2025?

The Fees mentioned below are the registration fees, not the coaching fees. The registration fees must be paid to “The Institute of Chartered Accountants of India” (ICAI).

Chartered Accountancy (CA) Course Registration Date in 2025?

Chartered Accountancy (CA) Registration date and examination date. The dates apply to all three levels CA Foundation, CA Inter and CA Final.

Event | May Exam Batch | November Exam Batch |

CA Exam Starting Date | 1st or 2nd week of May | 1st or 2nd week of November |

CA Registration Form Available | All year long | All year long |

Last Date for CA Registration | December 31st | June 31st |

Issue of online CA Examination Form | 1st Week of February | 1st Week of August |

Last Date to Submit the CA Examination Form | 1st Week of March | 1st Week of September |

Issue of CA Exams Admit Card in online mode | 1st Week of May | 1st Week of November |

Announcement of CA Exam Result | In the month of July | In the month of January |

The dates mentioned above are subject to change. For more details about the cut-off date, visit www.icai.org.

What documents are required for registering Chartered Accountancy (CA) Course?

The below-mentioned documents are to be scanned and uploaded at the time of registration. You can register for CA at www.icai.org. All documents have to be scanned and uploaded to this website.

Documents required for CA Foundation registration are required for CA Foundation Registration.

- Passport Photo

- Specimen Signature

- Age Proof

- Attested copy of 10th & 12th Pass Mark sheet – For 12th Passed Students

- Attested copy of proof of Nationality if the student is a foreigner.

- Attested copy of the proof of special category certificate, i.e. SC/ST, OBC, Differently abled.

Documents required for registration of CA Intermediate

These are the documents required for CA Intermediate Registration.

- Foundation Entry students need to upload the same documents which were provided earlier for CA Foundation.

- Direct Entry students must upload the above documents of CA Foundation and their UG/ PG – Semester Mark sheets.

- Direct Entry students who have completed CMA Inter / CS Executive must upload their mark sheet of Intermediate level examination of the Institute of Company Secretaries of India or the Institute of Cost Accountants of India along with the documents listed above in CA Foundation.

Documents required for registration of CA Final

CA Intermediate Pass (both Group-I & Group-II) Marksheet/Certificate. Along with the documents which were required for CA Foundation mentioned above.

Career opportunities for CA

Career opportunities for Chartered Accountants (CA) are given below:

- Public accounting firms: Auditing, tax advisory, and consulting services.

- Financial management: Overseeing financial operations within organisations.

- Investment banking and corporate finance: Mergers, acquisitions, and financial modelling.

- Risk management and compliance: Ensuring adherence to regulations and internal controls.

- Internal audit: Evaluating controls and recommending improvements.

- Taxation: Specializing in tax planning and compliance.

- Consulting: Financial advisory and strategy services.

- Entrepreneurship: Starting your own business or providing independent consulting.

- Government and regulatory bodies: Policy-making and enforcing financial regulations.

- Academia and education: Teaching in accounting and finance programs.

What is the role of a Chartered Accountant (CA)?

A Chartered Accountant (CA) plays a vital role in:

- Financial management and reporting

- Auditing and assurance

- Tax planning and compliance

- Corporate finance activities

- Providing strategic financial advice

- Ensuring regulatory compliance

Way forward

Don’t miss out on the chance to transform your accounting profession in 2023 with the help of Stride Edutech’s Ultimate CA Course. Empower yourself with the information and abilities you need to succeed as a chartered accountant.

Sign up immediately to open up a world of opportunities in the dynamic finance sector. Start today to create a better future for yourself and to pave the way for your professional success.

Still Having Doubts about the course?

Speak to our counsellor through WhatsApp

Chartered Accountancy (CA) - FAQ

Chartered Accountant (CA) is a designation given to an accounting professional who has received certification from The Institute of Chartered Accountants of India (ICAI) a statutory body.

Chartered Accountancy is a course conducted by The Institute of Chartered Accountants of India (ICAI).

Under the Scheme of Education and Training by The Institute of Chartered Accountants of India (ICAI), a candidate can pursue Chartered Accountancy Course either through Foundation Entry Route or Direct Entry Route.

Chartered Accountancy / Chartered Accountant

A CA is qualified to take care of the matters related to accounting and taxation of a business or for an individuals, like file tax returns, audit financial statements and business practices, maintaining records of investments, preparing and reviewing financial reports and documents. A Chartered Accountant is also qualified to offer advisory services to clients which include companies and individuals.

Approx. 2 Years study period + 3 years of Articleship

CA courses can be done either through Foundation Entry Route or Direct Entry Route.

After 12th, Register your self in ICAI through Foundation entry and clear all three levels with three years of articleship.

No. Articleship is mandatory for all students. Without completing 3 years of Articleship you are not eligible to do CA Final.

The Institute of Chartered Accountants of India (ICAI) is a statutory body set up by an Act of Parliament, viz. The Chartered Accountants Act, 1949 (Act No. XXXVIII of 1949) for the regulation of the profession of Chartered Accountancy in the country.

Once you registered in ICAI, the books will be sent to you through postal.

After B.com or any other degree with 50 and above percentage, Register yourself in ICAI through Direct entry and undergo orientation program and 9 months articleship then appear for CA inter. After that 2.3 years articleship and clear the CA final level.

First step: Understand the Concept and practise all the questions and problems.

Second step: Workout past five years of question papers of CA and CMA because some of the portions are commonly based on your le.

Third step: Before appearing the exams, test yourself by WRITING some mock test papers.

Visit the self-register portal (SSP) in ICAI and click New Foundation and Intermediate (Direct Entry)

There are 20 papers in 3 levels of CA Course. CA Foundation is excluded for Direct Entry candidates.

CA Foundation - 4 papers

CA Inter - Group 1 - 4 papers

CA Inter - Group 2 - 4 papers

CA Final - Group 1 - 4 papers

CA Final - Group 2 - 4 papers

ICAI conducts the exams in May and November every year. The exams in 2020 might be delayed due to Coronavirus lockdown.

For May exams, 31st Dec of the previous year is the last date for registration

For Nov exams, 30th June is the last date for registration.