Introduction

ACCA Optional Papers

If you’re preparing for the ACCA Strategic Professional Level, you’ve likely heard about the “optional papers.” This is one of the most important decisions in your ACCA journey because it doesn’t just affect your exam preparation — it can shape your career path in finance, audit, taxation, or strategy.

Many students ask us at Stride Edutech:

- 👉 “Which ACCA optional paper is easiest?”

- 👉 “Which paper has the best career scope in India and the Gulf?”

- 👉 “Should I choose based on my interest or salary opportunities?”

In this blog, we’ll break down the ACCA optional papers, explain what each paper covers, highlight career outcomes, and share pro tips to help you make the right choice.

What Are ACCA Optional Papers?

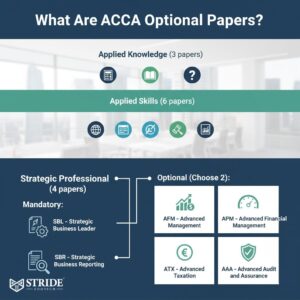

The ACCA qualification has three levels:

- Applied Knowledge (3 papers)

- Applied Skills (6 papers)

- Strategic Professional (4 papers – 2 mandatory + 2 optional)

At the Strategic Professional level, you must take two mandatory papers:

- SBL – Strategic Business Leader

- SBR – Strategic Business Reporting

After these, you select any two from four optional papers:

- AFM – Advanced Financial Management

- APM – Advanced Performance Management

- ATX – Advanced Taxation

- AAA – Advanced Audit and Assurance

Breakdown of ACCA Optional Papers

1. AFM – Advanced Financial Management

- Focus: Investment appraisal, mergers & acquisitions, corporate finance, risk management.

- Who should choose: Students aspiring to work in investment banking, CFO roles, or corporate finance teams.

- Career outcomes: Financial Analyst, Corporate Treasurer, CFO, Investment Consultant.

- Gulf relevance: High demand in UAE and Saudi for professionals with risk management and M&A skills.

2. APM – Advanced Performance Management

- Focus: Strategic planning, performance evaluation, business analysis.

- Who should choose: Students who enjoy consulting, strategy, and analytics.

- Career outcomes: Business Analyst, Management Consultant, Strategy Advisor.

- India relevance: Popular among students aiming for consulting roles with Big Four firms.

3. ATX – Advanced Taxation

- Focus: Domestic and international taxation, tax planning, compliance.

- Who should choose: Students interested in tax advisory or working with MNCs and audit firms.

- Career outcomes: Tax Consultant, Corporate Tax Manager, International Tax Advisor.

- Gulf relevance: UAE recently introduced corporate tax, making ATX highly valuable.

4. AAA – Advanced Audit and Assurance

- Focus: Complex audits, forensic accounting, assurance frameworks.

- Who should choose: Students aiming for a career in audit and assurance with Big Four firms.

- Career outcomes: Audit Manager, Assurance Specialist, Forensic Accountant.

- India/Gulf scope: Evergreen demand in EY, KPMG, PwC, Deloitte and mid-tier firms.

How to Choose the Right ACCA Optional Paper

When deciding, consider these factors:

1. Career Goals

- Want to become a CFO? → Choose AFM.

- Interested in consulting? → Choose APM.

- Love taxation? → Choose ATX.

- Prefer audit firms? → Choose AAA.

2. Market Demand

- In India, audit and taxation are high in demand.

- In the Gulf, financial management and performance strategy roles are booming.

3. Difficulty Level

- Many students find APM more challenging due to its subjective answers.

- AAA and ATX can be technical but straightforward if you enjoy their topics.

- AFM suits students with strong numerical and financial analysis skills.

4. Stride Mentor Tip

Don’t just pick the “easiest.” Choose the one that matches your career dream — because these papers shape your long-term job profile.

Career Impact of ACCA Optional Papers (Source: ACCA Global & Gulf job portals)

Mistakes to Avoid When Choosing

- Following friends blindly – Your career is unique.

- Choosing only by “easy to pass” – Market value matters more.

- Not considering Gulf opportunities – If you plan to work in Dubai or Saudi, ATX and AFM are excellent.

How Stride Edutech Supports You

At Stride Edutech, we don’t just teach — we mentor. Our support includes:

- Personalized counseling to select the right optional papers.

- Guidance from ACCA-qualified faculty with industry experience.

- Mock exams and past papers for all four optional subjects.

- Placement support in India and the Gulf.

💡 Internal links:

- ACCA After BCom: Is It Worth It?

- Top ACCA Exam Tips to Pass on the First Attempt

- Stride Edutech ACCA Course Page

Conclusion

The right ACCA optional paper can fast-track your career in finance, taxation, audit, or consulting. Think long-term, evaluate demand in India and the Gulf, and align it with your passion. And remember, with the right guidance, you can succeed in any paper.

FAQs

Q1. Which is the easiest ACCA optional paper?

It depends on your background. Many find ATX and AAA manageable, while APM can be more subjective.

Q2. Which optional paper is best for jobs in Dubai?

AFM and ATX are highly valued due to demand in corporate finance and taxation.

Q3. Can I change my optional paper later?

Yes, but it’s better to decide early to align with your career goals.

Q4. Do optional papers affect salary?

Yes — specialization in finance, taxation, or audit often decides your job role and package.

Call-to-Action

📞 Ready to start your ACCA journey?

Stride Edutech has guided 2,000+ students in India & the Gulf to global finance careers.

👉 Chat with us on WhatsApp today: +91 8939 688 188