Start your Financial Career with Stride Edutech

Best Institute to learn CA, CMA India, CMA US & CS.

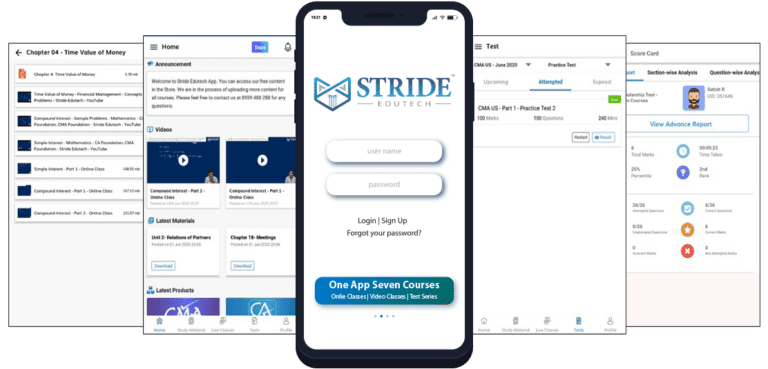

Download our App to get full videos access.

Face to Face Classes

Classroom Classes never goes out of fashion and you can attend at any of our 3 branches

Online Classes

State-of-the-art Online Classes with the ability to attend classes from anywhere in the world

Video Classes

Recorded Video Classes for all subjects with the Best Quality & available with 2 days FREE trial

Our Courses

Popular Courses

Our Courses

CBSE & Tamil Nadu State Board

Success Stories

Our Proud Achievers